If you are a small business owner in Maine you’ve probably seen all of the emails whizzing by about the Paycheck Protection Program (PPP) and Economic Injury Disaster Loan (EIDL) program funds being replenished. We just wanted to take this opportunity to provide you with information and links, both new and updated, to help you navigate this new funding landscape.

Paycheck Protection Program (PPP)

- If you previously applied in the first round earlier in the month, contact your bank loan officer and check the status of your application.

- If you did not apply in the last round of PPP funding, make sure your bank is an SBA lender and will be accepting applications once the process is reopened. You can search for a local SBA lender here. In addition to traditional banks, payment and financial management software companies like PayPal, Square, Kabbage, and Quickbooks are also authorized as SBA lenders. We do, however, recommend that you start with your local bank.

- If you don’t have an existing relationship with a qualified SBA lender, we can help match you with a lender taking new clients. Note—for the very small self-employed businesses, check with your local credit union. Contact Craig Olson at colson@islandinstitute.org if you need additional help.

Economic Injury Disaster Loan (EIDL)

- For the EIDL program, apply directly through the SBA. The site is not live yet for taking applications. For updates on the EIDL Loan Program, check here.

- For other options that might be available at the federal, state, or local level contact your local Maine Small Business Development Center Office for advice from a counselor.

WE’RE HERE TO SUPPORT YOU

These are just a few of the highlights in the stimulus package. But, one size does not fit all. There are going to be gaps. It is also our charge to determine what those gaps are and how we can find the resources to fill them. That’s where we need your help. If you’ve tried to access funding, can’t find more information for a specific program, or have a business that doesn’t seem to fit the funding guidelines, please let us know. Reach out to the Small Business team here: Craig Olson or Claire Donnelly

As the crisis progresses, we will continue to reach out with more information on how stimulus package resources can be used in your business or community.

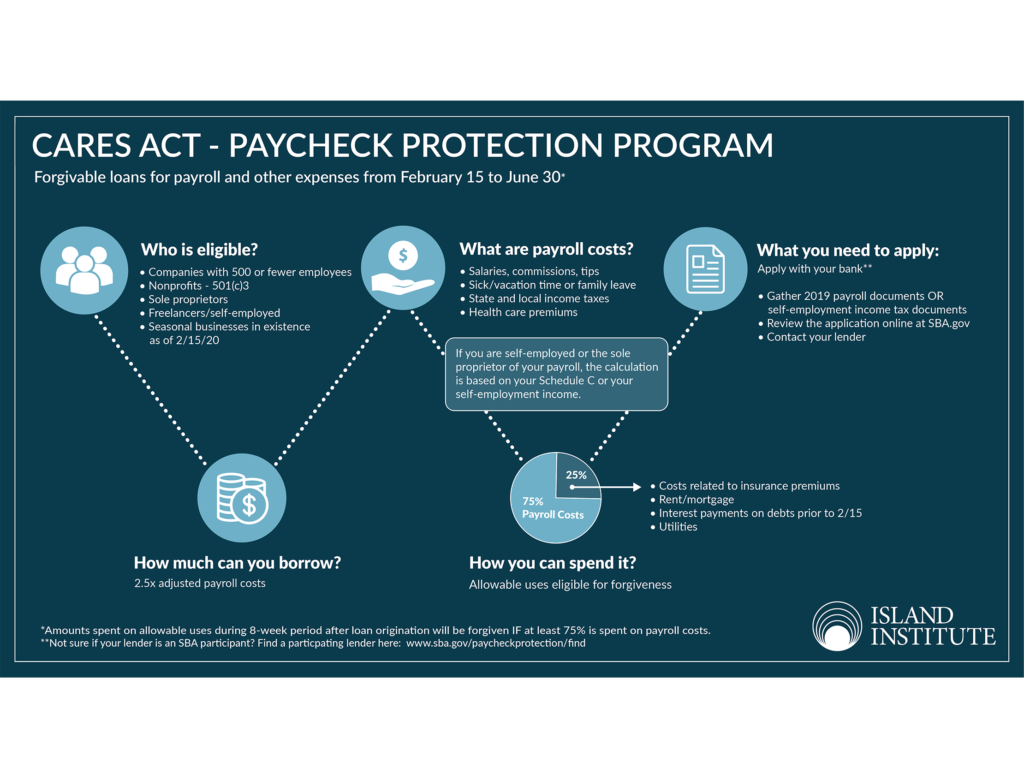

Need help navigating the details of the Paycheck Protection Program?

Check out our infographic above with all of the details, or download it here:

![]() Payroll Protection Program infographic

Payroll Protection Program infographic

ADDITIONAL RESOURCES

For additional resources to help support you right now, check out our recent webinars, podcasts, and resource pages:

- Coronavirus Resource Page

- Resources for Small Businesses, Artists, and Nonprofits

- Resources for the Aquaculture and Fishing Communities

- Resources & Social Services for Maine’s Coastal and Island Communities

- Commercial Currents podcast series: Business in Uncertain Times—Conservations with Maine’s Island and Coastal Small Businesses

- Building a Resilient Business in Uncertain Times (webinar)—Interested in learning more on how others are navigating change? Check out this webinar featuring local small business owners working hard to respond effectively to the global pandemic.